Introduction

The Journal entries are one of the most commonly used entries of accounting after receipt entries and payment entries. Journal entries is something which is taken into consideration when there is absence of both bank account as well as cash transaction in an accounting entry. Contrarily it then would be a receipt entry or a payment.

All this taken into consideration could be understood as the chief journal entries in Tally which could be created without much hassle. Nevertheless there always will be a number of journal entries but at the moment these are the ones which seems to be the major ones.

Why are the journal entries created in the first place?

The general entries are created for the closure of the book of accounts (Account books) at the end of a financial year for making any possible modifications or alterations. Moreover journal entries is something that is of a major significance of accounting and on the other hand for Tally as well.

One can surely imagine any single entry which does not fall under the following accounts and it will be then considered as a journal entry.

- Bank Account

- Cash Account

For instance if we pay attention to the entry of a depreciation. As we all know it is a journal entry that does not include any cash transactions and neither does it include any bank, purchase and sales as well hence considering it a journal entry.

In this blog post we will go through the 4 major journal entries which is used in day to day transactions. They include:-

- Entry for Sales on Credit

- Accrued Income entry

- Depreciation entry

- Entry for Purchase on Credit

So for better understanding it is a must that you should be acknowledged about the numerous journal entries and we are pretty much sure that by the time you reach the bottom of this wonderful blog on Journal entries you will be pretty well informed about numerous journal entries in Tally.

Table of Contents

How can we generate Journal Entries in Tally?

Creating journal entries in Tally is really simple as one just needs to choose the Journal Voucher from the vouchers that are available in Tally.

And then from the gateway of Tally one will have to pick or look for accounting vouchers

After that a user needs to reach out to the right hand sidebar which is green in color select Journal and push the F7 button for getting into journal voucher in Tally as shown below.

Now we will take a look on how various type of journal entries could be created in Tally as we have discussed in the above blog post.

Read:- Tally ERP 9 Tutorials Basic & Advanced online guides & classes

Keeping our fingers crossed it might keep you engaged in it

Journal Entry for Depreciation on Tally

Just before the journal entry for depreciation is created one should be aware of the numerous accounting entries available to suit the purpose.

For instance let us assume that an asset which we also known as a motor car. We at the moment may be having a motor car that costs around 10000 and the depreciation applicable on it is 1000/-

Then the accounting entry would be something like

Account for depreciation debited by 10000 and motor car account is credited by 1,000/-

If you fall short on the info on how a ledger is created for motor car (ASSET) depreciation one needs to go thoroughly in the blog post wherein there is detailed information about how ledgers could be created in Tally.

The depreciation entry for the above mentioned example will be illustrated in the image displayed below.

Now it is time for second journal salary entry in Tally ERP 9 which involves the transaction of accrued income

The Tally entry for Accrued Income (Journal Entry)

The term accrued income can be explained as the income which states that you are very much eligible for income but was never received a single time by you. Let’s take an example which will be very helpful for the further use in all the journal entries.

Read:- Maintaining journal for purchased returns- Get all the details

For instance we have an income that is received as interest amount paid from any person named Akash for a 1000/- but there is no sign of him depositing any interest amount in the bank account. That particular entry is an accrued income for an individual.

For the above transaction the journal entry will be something like.

Debit of Amit’s account for 1000 and the interest will be accrued income which will be credited by 1000/-

The Journal entry for the above acknowledged transaction is illustrated in the below snapshot.

That is how a journal entry for any accrued (income) expenses in Tally, while on the other hand is the complete opposite for the mentioned entry will be considered.

The next journal entry is the purchase on Credit

The journal entry for the Purchase of Credit in Tally is

Whenever it so happens that something is purchased on Credit, there is a possibility to generate a Purchase voucher in Tally. Let us create a journal entry for Purchase voucher in Tally

Any guesses on the journal entry for credit? It is that easy

For instance if Akash procures something on credit for which has a value of 5000. The following journal entry for credit purchase will be as mentioned under

Purchase account 5000 debited and Akash account is credited by 5000/-

Please remember in this scenario Akash will be the creditor as purchase is made from him on credit behalf.

For the above transaction the journal entry will be as visible in the picture

But for keeping it simple it is not included in the entry

Now it is time for last journal entry which is sales on Credit.

As it was mentioned earlier while creating a purchase entry in the Journal which can also be generated for the purchase voucher. Likewise sales entry which can also be generated with the support of a sales voucher.

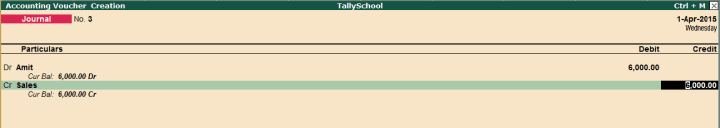

Let us create a simple journal entry for sales in Tally

Akash’s account will be debited by 6000 and the sales will be then credited by 6000/-

In this scenario Akash’s will be the debtor as the goods will be sold to him.

So the journal salary entry in Tally will be similar as shown in the below picture.

So what we are looking here is a sophisticated journal entry in Tally for the above acknowledged transaction which can no doubt be included as taxes, stock items and numerous other expenses as you wish.

As above mentioned all the four journal entries which is sufficient for day to day accounting transactions in a normal line of business.

Conclusion

The journal entries are an inseparable part of the accounting.

As food and water are important for surviving for all the humans, journal entries are that significant for accounting. There is a strong enough reason for that as they are the foundation of double (dual) entry system in accounting. Nevertheless accounting is more than just putting numbers in such a way that it makes a sense but Tally makes it rather easy to understand the various aspects of not only simple but numerous journal entries in accounting.